National giving campaign launched - updated

Posted on 28 May 2025

A national philanthropy campaign aimed at redefining how Australians can give more to help those…

Posted on 02 Nov 2023

By Greg Thom, journalist, Institute of Community Directors Australia

An innovative new microfinance program backed by Care Australia aims to support financially disadvantaged small business owners in the Asia-Pacific.

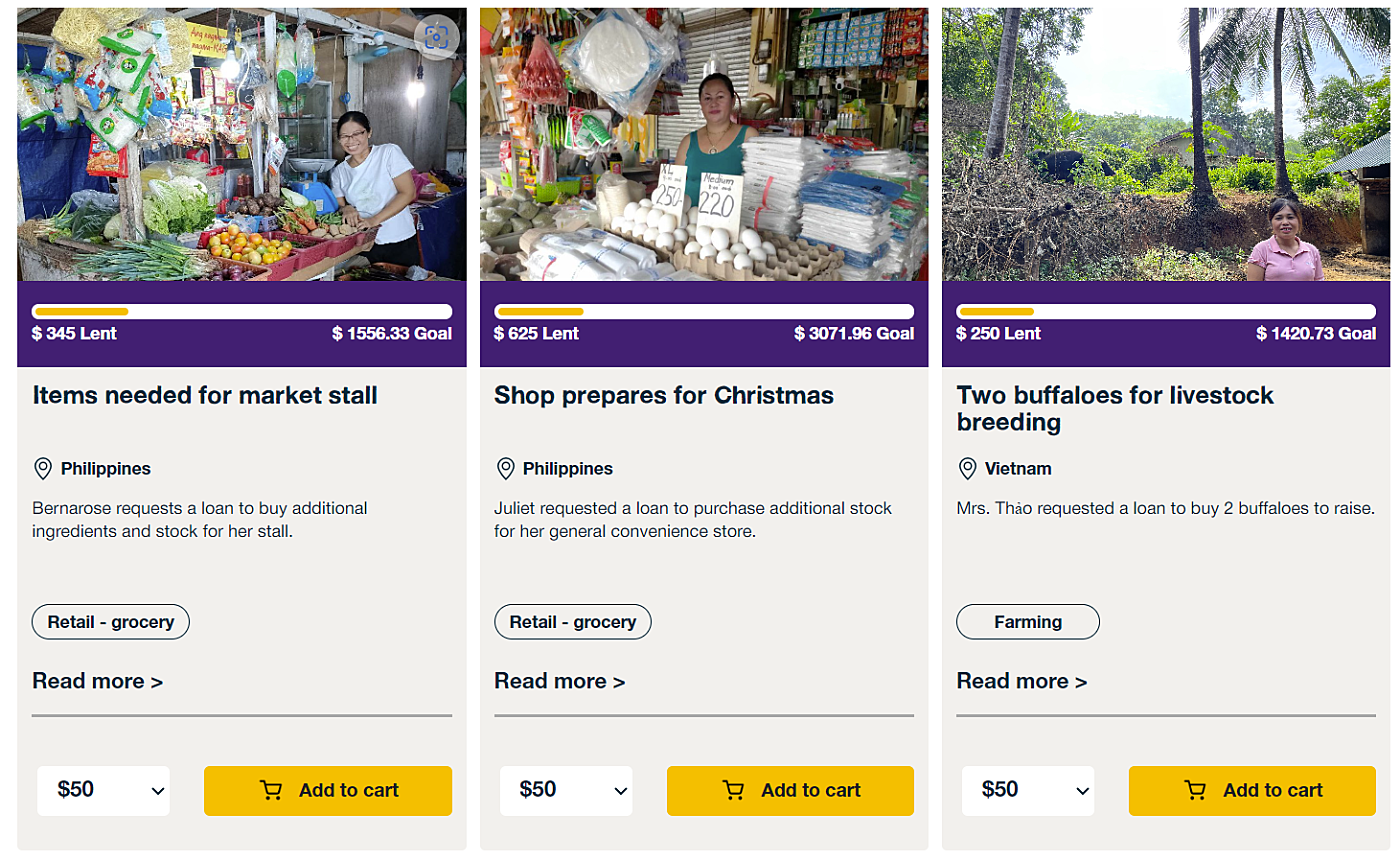

Lendwithcare allows Australians to invest in countries such as Vietnam, the Philippines and Thailand, enabling new and existing business owners to not only earn a living, but grow their enterprise.

Once their business is up and running or has achieved the goal of the loan, they repay the money.

Investors can then reinvest in another business, withdraw their money, or donate to Care Australia.

The program endeavours to address the financial barriers faced by small entrepreneurs in low-income communities as well as to provide Australians with a sustainable way to give to charity and help people change their lives.

It is estimated more than 1.4 billion people across the world don’t have access to the financial services they need to improve their quality of life.

Most of these are women living below the poverty line in rural areas with little opportunity to overcome financial barriers.

They include people like Ethyl, who requested a loan via Lendwithcare to purchase seeds and organic fertiliser for her small farm in the Philippines.

Or Vietnam-based Mrs Thao who needs extra cash to buy two buffaloes for livestock breeding.

Visitors to the Lendwithcare website can see pictures of both women, their financial goals and how much has been donated to their causes so far, before deciding whether to contribute at the click of a button.

Care Australia said many women around the world can’t access the money and support they need to start or grow their businesses.

This is because firms owned by women tend to be smaller than those owned by men, meaning women are often left with few options when financial times get tough.

The Lendwithcare program helps address this gender gap, with most loans going to small businesses run by women.

Along with generating economic growth, access to financial services can have a positive knock-on effect, opening the door to more independence, educational opportunities and, most importantly, hope.

First launched in the UK, Lendwithcare has now been established in Australia in a bid to close the financial gap in the Asia-Pacific.

“Microfinance empowers those who may otherwise be disenfranchised.”

CARE Australia CEO Peter Walton said microloans give hope and can transform lives, especially the lives of women and children.

“Lendwithcare is also about solidarity,” said Mr Walton.

“It is a platform rallying Australians to make a direct impact on the lives of people who often don't have access to the hand up that they need to support their families.

“Microfinance empowers those who may otherwise be disenfranchised.”

Mr Walton said as part of an international confederation, CARE Australia is uniquely positioned to be the bridge between capital in hand, and the communities CARE works with around the world who need additional support.

"Lendwithcare creates a virtuous cycle of empowerment and opportunity,” said Mr Walton.

“Borrowers gain the means to support themselves and empower their communities.

“Lenders, in turn, experience the satisfaction of seeing their initial loan not only transform one life, but also continuously multiply its impact when re-lent to more and more deserving individuals."

Lendwithcare ambassador and businesswoman Naomi Simson said there was an estimated $1.7 trillion financing gap for female entrepreneurs in low-and middle-income countries.

“Lendwithcare will seek to change this and provide an amazing opportunity for Australians to help make a real and positive impact.”

Posted on 28 May 2025

A national philanthropy campaign aimed at redefining how Australians can give more to help those…

Posted on 05 Mar 2025

This year’s social impact high achievers come from a family dispute resolution service, a…

Posted on 05 Mar 2025

An alarming epidemic of weaponised gender-based violence is silently escalating in the shadows of…

Posted on 17 Feb 2025

A new report has called for the introduction of a legally enforceable right to housing across the…

Posted on 15 Feb 2025

Bitterly disappointed charities have slammed the passing of new electoral reforms they claim will…

Posted on 14 Feb 2025

The Trump administration's gutting of USAID threatens to undermine decades of progress in…

Posted on 13 Feb 2025

While Australia has had some trailblazing female politicians over the years, the road to political…

Posted on 12 Feb 2025

The election of Donald Trump as US president is an expression of a pervasive cultural shift away…

Posted on 11 Feb 2025

Charity and not-for-profit organisations have banded together to voice their concerns that the…

Posted on 10 Feb 2025

The hiring Indigenous business managers by non-Indigenous businesses can help close the employment…

Posted on 10 Feb 2025

The targeting of a Geelong food relief charity by brazen thieves who cleaned out the organisation's…

Posted on 10 Feb 2025

Australian parents are banding together to ensure their kids are not robbed of their childhoods by…